Wise vs Zelle: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 13:35:27.0 17

Introduction

Cross-border money transfers are increasingly vital for individuals and businesses, but users often encounter high fees, slow processing, hidden charges, and poor platform usability.

Wise stands out for transparent fees, mid-market exchange rates, and extensive global coverage, while Zelle specializes in instant domestic transfers and easy bank-to-bank payments within the U.S.

For users needing international alternatives, Panda Remit provides fast delivery, low fees, and multiple payment methods (https://www.pandaremit.com/).

For a guide on international transfers and remittance costs, see Investopedia’s article on cross-border payments (https://www.investopedia.com/articles/pf/08/international-banking-transfers.asp).

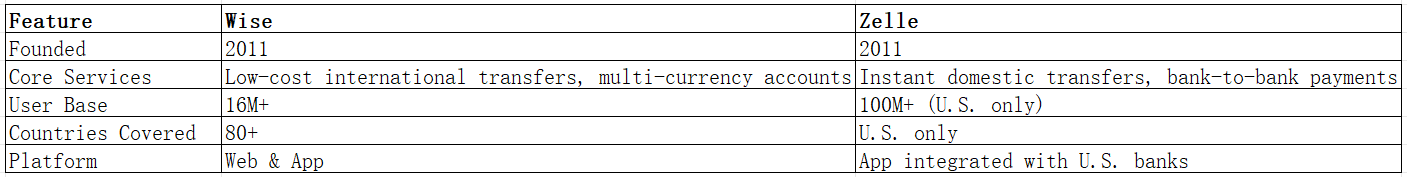

Wise vs Zelle – Overview

Wise, founded in 2011, offers low-cost international transfers, multi-currency accounts, and debit cards. It serves over 16 million users in 80+ countries.

Zelle, founded in 2011, provides real-time domestic transfers between U.S. bank accounts. It has over 100 million users in the U.S., but does not support international transfers.

Similarities: Both offer mobile apps, secure transfers, and digital payments.

Differences: Wise enables global transfers with transparent fees, whereas Zelle focuses on instant U.S.-based payments with no international reach.

Panda Remit is a fast, cost-effective alternative for international money transfers (https://www.pandaremit.com/).

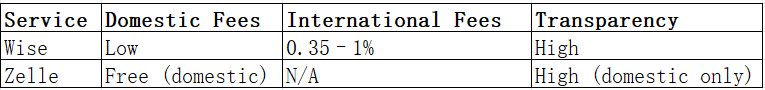

Wise vs Zelle: Fees and Costs

Wise charges 0.35%–1% per transfer, with full transparency and no hidden fees.

Zelle is typically free for users with participating U.S. banks, though instant payments through some banks may incur small fees. International transfers are not supported.

For detailed fee comparisons, see NerdWallet’s money transfer guide (https://www.nerdwallet.com/best-money-transfer-services).

Panda Remit often provides lower fees for international transfers compared to Wise, making it a strong alternative for cost-conscious users.

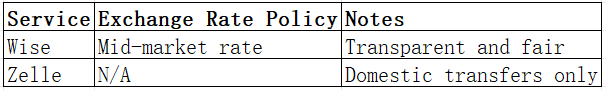

Wise vs Zelle: Exchange Rates

-

Wise uses mid-market exchange rates, ensuring minimal markups.

-

Zelle does not handle foreign exchange since it is U.S.-only.

Panda Remit also provides competitive exchange rates, which is useful for international senders.

Wise vs Zelle: Speed and Convenience

Wise transfers are generally completed within minutes to one business day, supporting batch payments, debit cards, and multi-currency accounts.

Zelle enables instant transfers between U.S. bank accounts, which is convenient for domestic payments but does not support international transfers.

For insights into transfer speed and delivery, see the World Bank Remittance Prices guide (https://www.remittanceprices.worldbank.org/en).

Panda Remit offers fast international transfers with multiple payout options, making it an ideal alternative for global payments.

Wise vs Zelle: Safety and Security

Both services are regulated and secure:

-

Wise is authorized by the UK FCA and other global regulators.

-

Zelle is integrated with U.S. banks, following federal banking regulations and secure banking protocols.

Both use encryption, two-factor authentication, and fraud detection systems. Panda Remit is also licensed and secure, ensuring safe international transactions.

Wise vs Zelle: Global Coverage

Wise supports 80+ countries and 50+ currencies, suitable for global remittance users.

Zelle is U.S.-only, limiting its use to domestic transfers.

For further global remittance data, see the World Bank coverage report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data).

Wise vs Zelle: Which One is Better?

Wise is the best choice for international transfers, transparent fees, and fair exchange rates.

Zelle is ideal for instant U.S.-based payments and users who only need domestic bank-to-bank transfers.

Panda Remit is a strong alternative for international remittance, offering low fees, fast delivery, multiple currencies, and flexible payment options.

Conclusion

When comparing Wise vs Zelle, consider your transfer needs:

-

Wise: Transparent fees, mid-market exchange rates, global reach.

-

Zelle: Instant domestic transfers, easy bank-to-bank payments within the U.S.

For international transfers, Panda Remit (https://www.pandaremit.com/) provides:

-

High exchange rates & low fees

-

Flexible payment methods, including POLi, PayID, bank card, and e-transfer

-

Coverage of 40+ currencies

-

Fully online, fast transfers

For further insights, see NerdWallet (https://www.nerdwallet.com/) and World Bank Remittance Prices (https://www.remittanceprices.worldbank.org/en). By comparing Wise vs Zelle and Panda Remit, users can select the most cost-effective, reliable, and convenient money transfer service.